In early 2021, Small Business Majority conducted a national survey of small business owners, and issued a special brief looking at the specific needs of AAPI survey participants. The number one challenge cited by AAPI survey participants was the difficulty they faced in navigating federal, state, and local relief programs for small businesses (58%). Half of AAPI entrepreneurs surveyed for this report (50%) applied for the federal Paycheck Protection Program in 2020. Of those surveyed who applied, half (51%) said the PPP application process was difficult. Of those who applied, 80% said they received the loan. Only 23% said they received the full amount they requested, as compared to 33% of all small businesses surveyed for this study. 76% of AAPI entrepreneurs surveyed have applied for PPP loan forgiveness and 64% were approved. Of those who didn’t apply for forgiveness, 62% said they were confused about the process, compared to 23% of all small business owners. It should be noted that Small Business Majority’s survey was conducted in English, which implies that limited English proficient AAPI entrepreneurs likely faced even greater hurdles in accessing government relief programs.

Publicly available data provides limited information of the racial demographics of entrepreneurs who accessed federal pandemic relief programs. Because demographic data is not required and only voluntarily submitted, only 25% of round 1 and round 2 of the PPP program loans identify the race of business owners who applied. In early 2021, the SBA began releasing available data by race, and as of April 25, 2021, Asians accounted for only 2.5% of the total number of approved PPP loans in the program’s third round (of those that reported data on race).

Without the appropriate and early intervention, entrepreneurs of color were (and are) clearly being left behind. Asian American, Native Hawaiian, and Pacific Islander (AAPI) small businesses are disproportionately concentrated in the industries that are most impacted by the COVID-19 pandemic. According to the Survey of Business Owners (2012), nineteen percent (19%) of firms in the Accommodation and Food Services (NAICS 72) sector are Asian-owned businesses. Nine percent of all Retail Trade (NAICS 44-45) firms are Asian American and Pacific Islander.

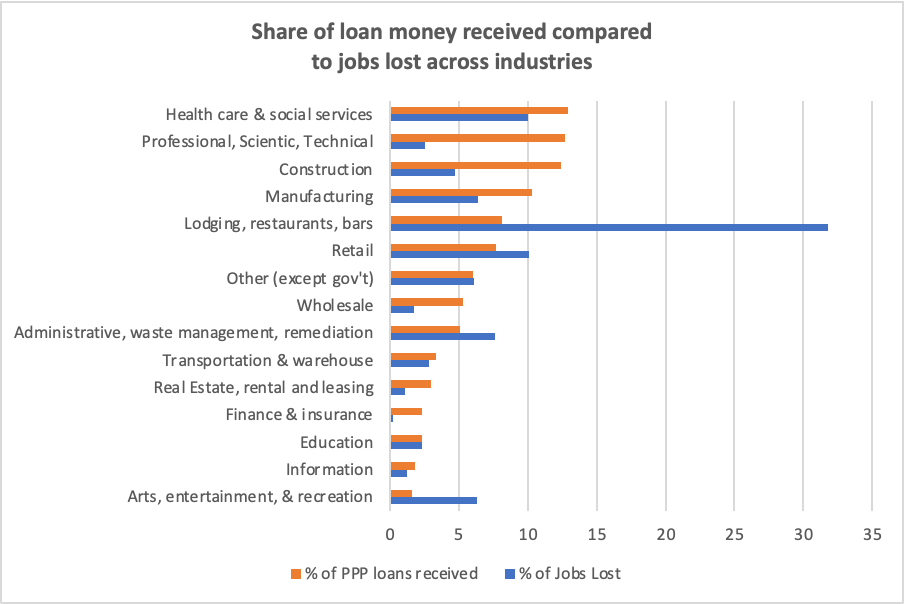

These are among the most vulnerable economic sectors during the COVID-19 pandemic. These two economic categories accounted for 42% of the estimated low-wage jobs lost due to the pandemic in 2020. However, the primary federal response to support small businesses impacted by the pandemic – the Small Business Administration’s Paycheck Protection Program (PPP) – had not reached these sectors in proportion to these job losses.

According to data released by the Small Business Administration, participating lending institutions had approved over 5 million loans, totaling over $525 Billion in PPP loans as of August 8, 2020 when the second round of PPP funding closed. Only 16% of PPP loans had gone to businesses in these two vulnerable sectors. Combined, the most vulnerable economic sectors have received over $83 Billion in PPP loans, or 16% of the total loan funding approved.

In comparison, the top 4 economic sectors by PPP loan amount (Health Care, Professional Scientific, Technical Services, Construction, Manufacturing) received a total of 48.3% of the total amount of PPP dollars approved and have had 24% of the total low-wage jobs lost. For these sectors that have received the lion’s share of PPP loan approvals, job losses have not nearly been as severe as for the impacted/underserved sectors of the economy:

Source Data: Washington Post article on October 5, 2020

Source Data: Washington Post article on October 5, 2020

National CAPACD members cite the following as major barriers to their AAPI clients in accessing federal pandemic relief resources:

- Information was inaccessible and constantly changing: Limited English Proficiency prevented many from accessing critical information in a timely manner. Despite a roll-out of the PPP program in early April 2020, translations in other languages about the PPP did not become publicly available by the SBA until the end of that month, by which time, all funds of the first round of PPP had already been exhausted. Clients also cited confusion about the different relief programs and how they interacted, eligibility and requirements for repayment. This confusion was further exacerbated by the fact that guidelines were constantly shifting and it was difficult to determine what was the most recent version of information.

- A complicated and challenging application process: In addition to the above-stated issues, AAPI small business clients also cited technology as a major barrier in the application process for federal relief programs via the online platforms. Many lacked access to basic technology (computer, scanner, etc). This technological barrier was made only more complicated for those who were also limited English proficient. For the PPP program in particular, it also became clear that there was a lack of communication from SBA and lenders to borrowers about the process. National CAPACD members also cited that some clients lacked clarity on eligible supporting documents, did not have them readily accessible and required more time to gather the information, or did not have proper documentation at all. The cumbersome application processes assumed that immigrant and refugee small business owners have similar access to information, resources, capital and legal and accounting support as wealthier, mainstream business owners.

- A lack of formal banking relationships and lack of training for lenders: For AAPI entrepreneurs, as with other entrepreneurs of color, one of the greatest barriers to accessing federal relief was their lack of a pre-existing banking relationship that would have made it possible for them to access a loan earlier. As was widely publicized in national media, small businesses were the last to be served by the PPP (round 1) when going through major banking institutions. Were it not for the second and third rounds of funding and dedicated CDFI funding streams, many National CAPACD members doubt their clients would have been able to access PPP funds. Further, AAPI small business clients found that some lenders lacked training and preparation due to the quick roll out of the PPP, resulting in miscommunication and errors during the application process.

- Timing: Small business clients cited long wait times to receive funds, with fears that their businesses wouldn’t make it until funds were in hand.

- Scams on the Rise: The complicated nature of the PPP and EIDL loan application processes made it ripe for scrupulous individuals to take advantage of unknowing or overwhelmed business owners, particularly those that do not speak English as a first language. National CAPACD’s members across the country cited instances of predatory practices and scams, including from those within their own community.

As one small business provider within National CAPACD’s network put it in Fall 2020: “SBA PPP loans were not enough to help them with all the business loss/expenses. They really need rent relief and grants. I’m really afraid that if [this pandemic] continues, more than half our small businesses will not survive and this will leave communities empty with no economic activity. Government needs to put grant dollars quickly into small businesses to help them with expenses relief. SBA PPP was a bureaucratic disaster and had onerous processes and administrative headaches. Government needs to create a simple and easily accessible small business grant program without small businesses going through so many hurdles.”